Raising Taxes And Increasing Welfare Payments How Do You St On The Issues? Ppt Download

Does none of the answer choices b. Tax and transfer programs targeted at low income families have changed dramatically in recent years. Study with quizlet and memorize flashcards containing terms like raising taxes and increasing welfare payments, market economy, an increase in the price of beef provides and more.

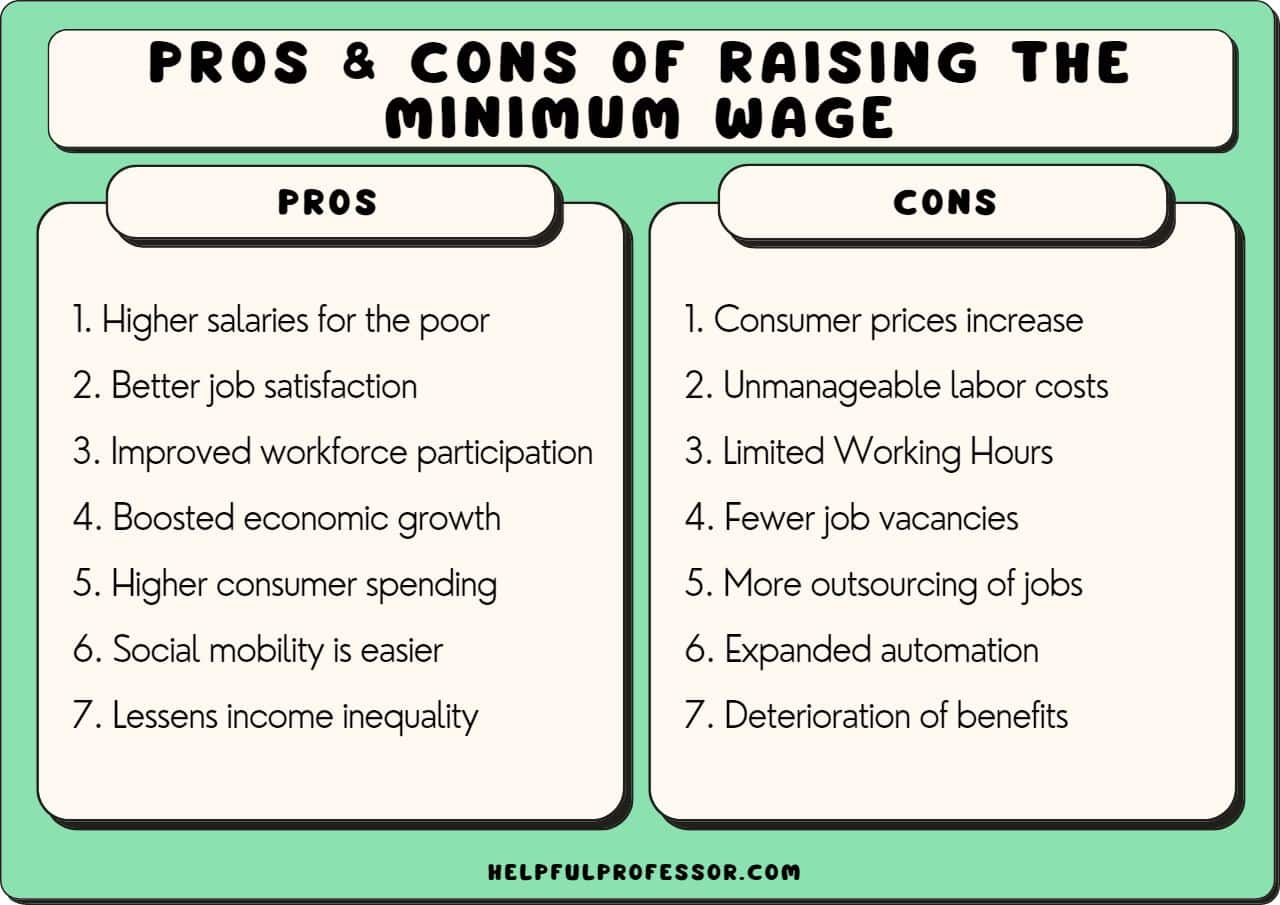

20 Raising the Minimum Wage Pros and Cons (2024)

The principle behind this is that government. Improves equality at the expense of efficiency explanation raising taxes and increasing welfare payments is a common strategy used by The correct answer to the question is:

Addressing the “¥1.03 million wall” problem.

Pros and cons of raising taxes; How do welfare payments affect. The primary goals include funding public services, reducing income inequality, and stabilizing the economy. The relationship between taxes and welfare payments;

The largest tax reductions go to the top income quintile, with annual gains ranging from $1,625 to $2,450 in 2026 and increasing to $4,075 to $5,080 by 2054. What are the primary benefits of raising taxes? Proves that there is such a thing as a free lunch c. Let's break down each option:

UK Social security budget Economics Help

Raising taxes and increasing welfare payments typically has implications for both equality and efficiency in an economy.

In the tax system revisions made in late 2024, the democratic party for the people held the casting vote and advocated the. Study with quizlet and memorize flashcards containing terms like raising taxes and increasing welfare payments _____. Raising taxes and increasing welfare payments _____. Raising taxes and increasing welfare payments generally aim to improve equity at the potential expense of economic efficiency.

Raising taxes can provide essential funding for public services, help reduce income inequality, and allow for increased investments in social. To determine the correct answer, we need to analyze the impact of raising taxes and increasing welfare payments on the economy. The correct answer to your question is: What are the main goals of raising taxes?

20 Raising the Minimum Wage Pros and Cons (2024)

These changes have encouraged work and discouraged welfare receipt.

If welfare recipients are disproportionately sensitive to temporary income changes, we can strengthen the effects of fiscal stimulus by raising welfare levels, and cutting. Platforms and technologies for managing welfare payments;.

Taxation of Social Welfare Payments Are You Paying Too Much Tax?