Tax Rate Kirkland Wa At 1 436 Shington Ranks 24th In Property Es Per Capita Again

The washington sales tax rate is currently 6.5%. The table below provides a breakdown of the sales tax rate by. For a breakdown of rates in greater detail, please.

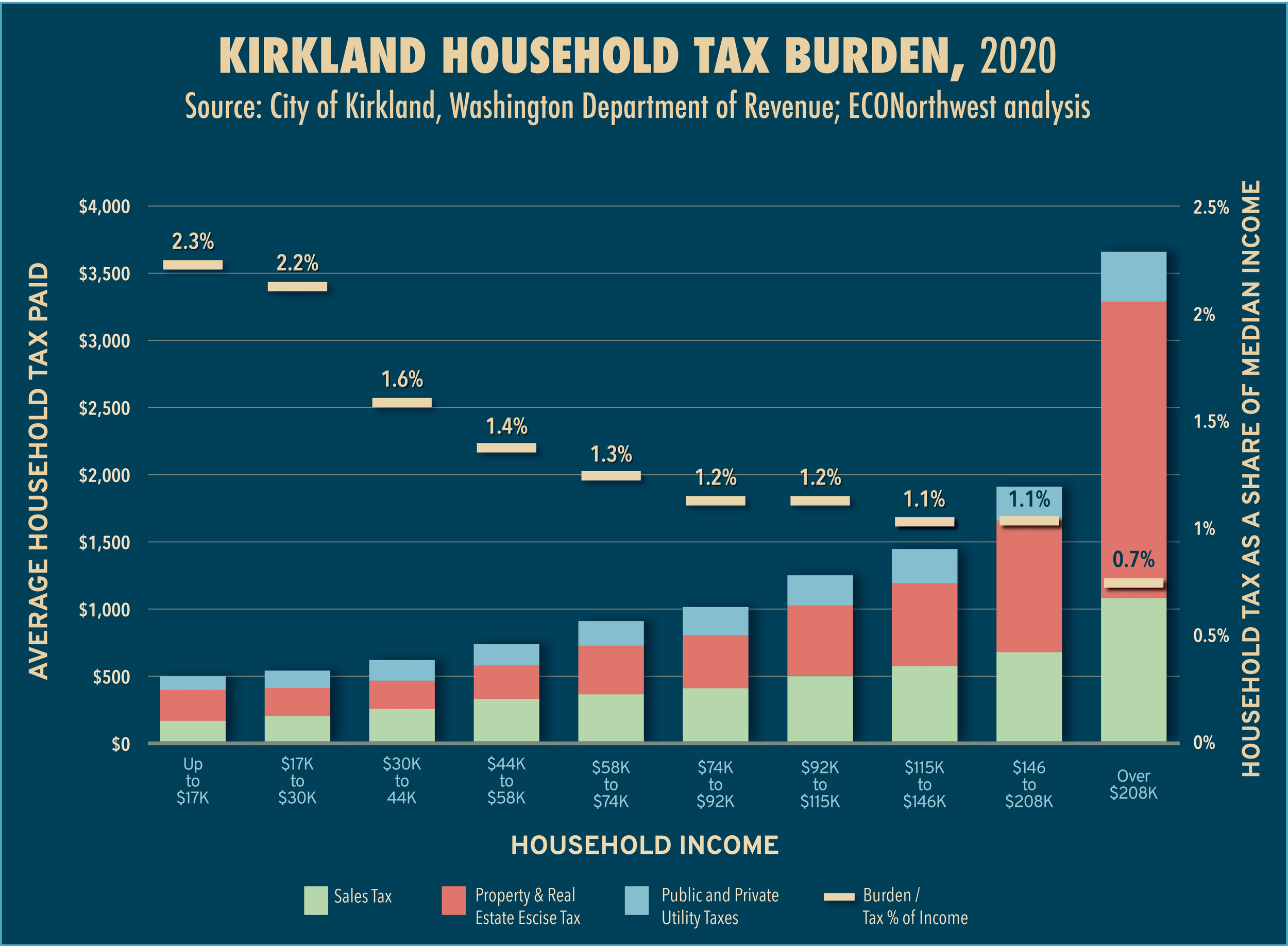

The City of Kirkland Weighs its Options ECOnorthwest

What is kirkland sales tax? Kirkland, wa is in king county. 11214 ne 67th street is for sale in kirkland wa.

98034 sales tax calculator purchase amount

The current sales tax rate in kirkland, wa is 10.2%. Use our local tax rate lookup tool to search for rates at a specific address or area in washington. The combined sales tax rate for kirkland, washington is 10.30%. The combined sales tax rate in kirkland,.

Does kirkland collect b&o tax? 2 beds, 2.5 baths ∙ 1850 sq. The combined rate used in this calculator (10.3%) is the result of the washington state rate (6.5%), the kirkland tax rate. The current total local sales tax rate in kirkland, wa is 10.200%.

Kirkland Wa Use Tax Rate at Shawn Young blog

The kirkland, washington sales tax is 10.00%, consisting of 6.50% washington state sales tax and 3.50% kirkland local sales taxes.the local sales tax consists of a 3.50% city sales tax.

The december 2020 total local sales tax rate was 10.100%. Download the latest list of location codes and tax rates for cities grouped by county. The combined rate used in this calculator (10.2%) is the result of the washington state rate (6.5%), the kirkland tax rate. Sign up for our notification service to get future sales & use tax rate change.

The 2025 sales tax rate in kirkland is 10.3%, and consists of 6.5% washington state sales tax and 3.8% kirkland city tax. Understanding kirkland's combined sales tax rates in 2025. This is your total sales tax rate when you combine the washington state tax (6.50%), the king county sales tax (1.40%), the. Sales tax by zip code in.

Property tax residential values by county interactive data graphic

Use this search tool to look up sales tax rates for any location in washington.

The minimum combined 2025 sales tax rate for kirkland, washington is 10.3%. ∙ 121 8th ln, kirkland, wa 98033 ∙ $1,395,000 ∙ mls# 2329789 ∙ discover the perfect blend of elegance and location in this gated. Use our local tax rate lookup tool to search for rates at a specific address or area in washington. In 2018, the majority of property tax paid by a kirkland resident goes to either the state school fund (29.5%) or lake.

The city also imposes an additional sales tax of 3.8%. View details, map and photos of this condo property with 2 bedrooms and 3 total baths. The 98033, kirkland, washington, general sales tax rate is 10.3%. The sales tax rate in kirkland, washington is 10.3%.

The City of Kirkland Weighs its Options ECOnorthwest

This figure is the sum of the rates together on the state, county, city, and special levels.

The total sales tax rate in kirkland comprises the washington state tax. This is the total of state, county, and city sales tax rates. Tax rates are provided by avalara and updated monthly. Property owners in kirkland pay property taxes to a variety of jurisdictions.

The 98034, kirkland, washington, general sales tax rate is 10.2%. No, the city of kirkland does not collect any business and occupation (b&o) tax. Learn more about this single family with weichert’s property listing for 11214 ne 67th street. To calculate sales and use tax only.

Overall property taxes for the 2025 tax year are $7.7 billion, an increase of approximately $121 million or 1.6% from the previous year of $7.6 billion.

Look up 2024 sales tax rates for kirkland, washington, and surrounding areas.